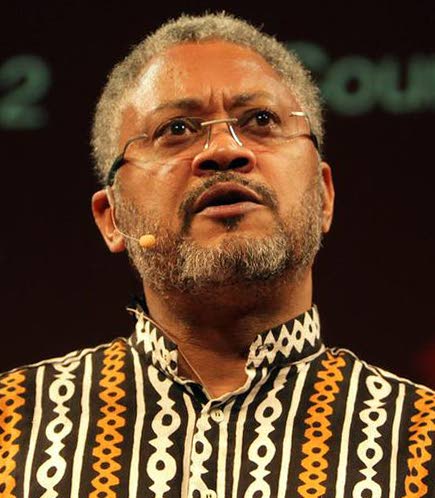

Afra Raymond: Sandals lawsuit raises questions about TT hotels

JAMES LANSER

CHARTERED surveyor and activist Afra Raymond, who was critical of Sandals coming to Tobago, says he smiled when he received the news that Sandals Resort International is being sued for tax fraud. He added that the case raises questions about hotels in TT.

Sandals is being sued for allegedly charging guests 12 per cent tax rates and pocketing the money instead of paying the taxes to the governments of various Caribbean islands.

Raymond said the grounds for the lawsuit brought against Sandals were only possible after secret duty-tax evasions were uncovered in the Turks and Caicos Islands.

Raymond said this case shows the importance of transparency. He said, “Without those secret deals having been disclosed, how would those suing Sandals have been able to know they were being charged in the incorrect and dishonest way as alleged in their lawsuit?”

Raymond said TT should be asking exactly what is happening currently with hotels here, as TT has secret tax and duty concessions and arrangements for large hotels, making it possible for the same sort of problems to occur.

He formally wrote to the Board of Inland Revenue in October 2016 to ask in respect of the three state-owned hotels (Hilton Trinidad, Magdalena Grand and Hyatt Regency) whether the correct returns had been filed and/or the correct taxes due had been paid, he said.

He says although there had been two official disclosures of taxes paid by these hotels, the BIR still refused to say whether the correct terms had been filed.

The two disclosures of taxes came on March 19 and on April 30.

The first disclosure was of taxes paid by the Hilton Trinidad and Magdalena Grand, Tobago. The second disclosure was for VAT paid and PAYE for the Hyatt Regency.

Comments

"Afra Raymond: Sandals lawsuit raises questions about TT hotels"