A tale of two TTs

Listening to any debate on TT’s economy, it’s hard to reconcile that it’s the same country being discussed. According to the Government, after years of negative growth, perpetuated by rampant spending on the part of the now Opposition, the country is on a rebound. To hear the Opposition tell it, TT is falling hard and fast, with no real investment, stagnant GDP growth and massive job losses.

This was played out most recently in, first, the Opposition’s motion of no confidence in the Government’s handling of the economy last Friday in the Parliament, and again on Monday, when Finance Minister Colm Imbert read his mid-year review of the budget.

“Simply put, sound and stable macroeconomic conditions, in particular low inflation and stable interest rates have laid the foundation on which savings and investment are being generated in an environment of certainty with improving prospects for growth,” he said.

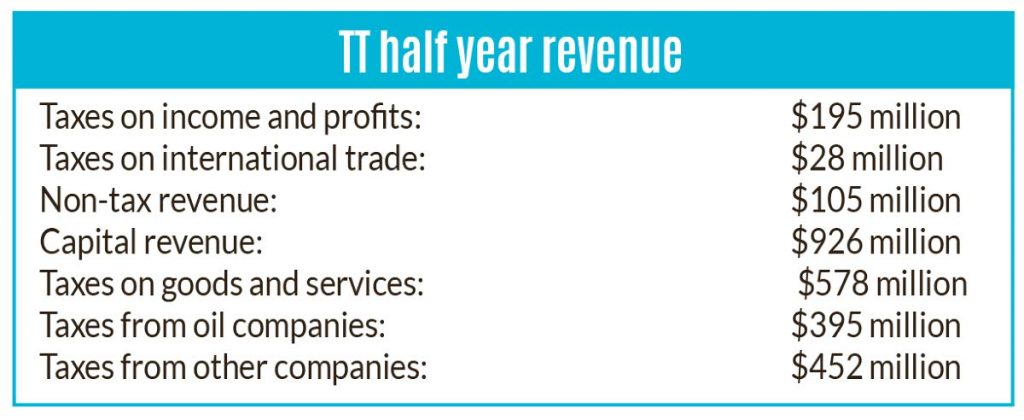

Revenue in the first half of 2019 was $706 million above the estimates, while expenditure was $2.55 billion below. The actual recorded deficit for the first half of 2019 was only $1.85 billion. This from overall revenue projected at $47.7 billion, expenditure at $51.77 billion and the deficit at $4.05 billion when the budget was read in October. There’s still the next half of the year to deal with, though, and Imbert did note he had to make some changes.

Total expenditure has been revised upwards to $52.07 billion, an increase of approximately $300 million. Lower oil revenue in the first half the year also meant revenue had to be reviewed to $47.5 billion, down by $221 million. The deficit then would increase by about half a billion dollars to $4.57 billion. The budgeted oil price had to be revised down from US$65 per barrel to US$60, and gas prices up to US$3 per MMBtu from US$2.75.

“The achievement of the stabilisation objectives with revenue and expenditure now in broad alignment represents a solid foundation on which transformation and growth would now be anchored,” he said.

Resources would be directed to infrastructure development including roads, highways, bridges and hospitals, and paying off commercial suppliers and contractors, as well as liquidating VAT refunds, “with a view to improving business conditions.”

As much as the Finance Minister assures of turnaround, though, the challenge for most people is it’s hard to reconcile macroeconomic growth and stability – admittedly, an achievement in itself – with their personal experience. With the closure of the Pointe-a-Pierre refinery at least 5,000 immediately lost their jobs. Even though several were absorbed into the new entities that replaced Petrotrin – Heritage Petroleum and Paria Fuel Trading Company Ltd – there’s still the impact on fence line communities, as well as ripple effects through services and other support industries.

And as much as the Government has stabilised the economy, there’s been no real major industrial development. Much of what the country is benefiting from now is from polices and investment manoeuvres implemented by the previous administration, including incentives to energy companies to increase exploration and Caribbean Gas Chemical's dimethyl ether plant, which is scheduled to open in January.

This is the uncertainty that Opposition Leader Kamla Persad-Bissessar tried to capture in her rebuttal to Imbert’s presentation.

“Last year, I told the House the economy is sick, on life support. The economy is dead because of the actions and inactions of the Government,” she said.

Imbert’s figures may be cherry picked, she said, and gave no comfort to people who have no food on their table or jobs to go to. “At the end of the day," she said, "you cannot eat statistics. You cannot take numbers, put it in your pocket and go to the grocery to buy groceries.”

Economic expansion drive

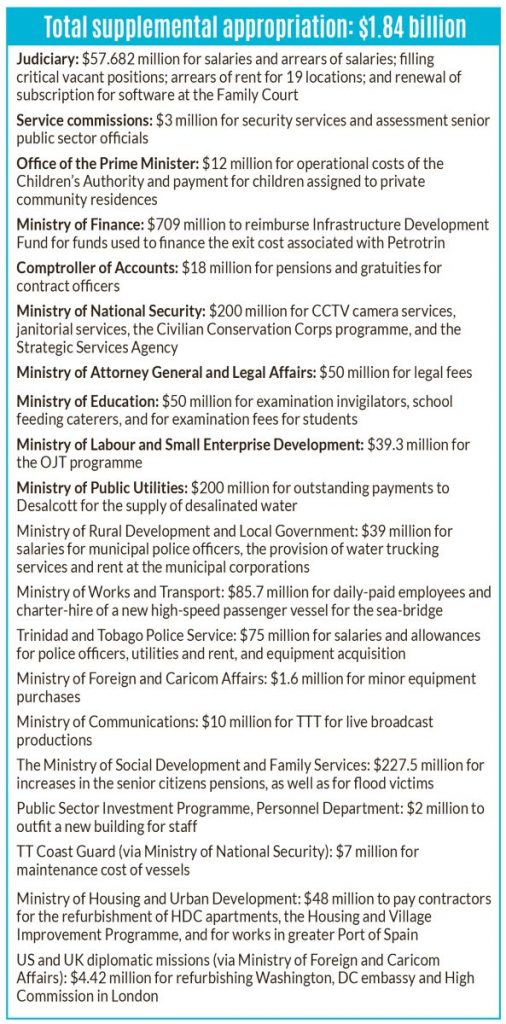

What the country can hope for though, is that over the next two years, the expansionary thrust of the Government, especially in infrastructural development and housing. The long-awaited housing bonds to finance the construction of Housing Development Corporation units is expected in two months, a new fast ferry for the sea-bridge is expected “shortly” and Imbert will soon give his approval for the Tobago House of Assembly to raise $300 million in loan financing for infrastructural projects. Imbert also requested $1.84 billion in supplemental appropriations for ministries and state agencies.

What he didn’t do too much, though, was diversification, although he did give some private sector shout-outs to the manufacturing sector. The fact remains, however, that TT is still a country dependent on hydrocarbon commodities. In fact, he downplayed the impact of arguably the biggest news in country – BPTT’s recent announcement of “disappointing results” in the Columbus Basin, which could impact the future of Atlantic’s Train One. He also said the loss of Venezuela’s Dragon gas would not “collapse the economy.”

The country’s natural gas output, by far the greatest contributor to GDP was steadily rising, from 3.3 billion standard cubic feet per day in 2017 to 3.6 billion in 2018 and now to 3.8 billion in 2019. The government is hopeful that by 2021 the country can average over four billion, with February output this year hitting that mark for the first time since 2015. “There is continuous growth and momentum in the production of natural gas and that is what is driving our economy,” Imbert said.

He also cited key indicators in the country, like massive commercial bank profits (Republic’s half year profits were $783 million), life insurance contracts were up from $3.8 billion in 2015 to $4.4 billion in 2018, and the number of cars on the road were over one million, with 25,000 new registrations annually.

Diversification then, remains the kicker. Imbert mentioned that former Petrotrin workers would soon be able to access land grants, including for agriculture, the Moruga agro-processing plant and the light industrial park in Couva, but timelines are still sketchy.

Not to be outdone, Persad-Bissessar presented her party’s alternative plan to improve the economy and create thousands of jobs. Key among them, policies for diversification, though the execution was not quite clear.

“Diversification is at the heart of our economic master plan. We will encourage strategic investments in niche non-energy sectors where we have strong competitive advantage, market opportunity and growth potential,” she said. “We will … get our people working again and working towards a better future.”

Budgets – and their rebuttals – are political documents. Indeed, as the opposition leader proved, it can be a near manifesto. There are two elections coming up over the next year – local government elections scheduled for the end of this year, and the general election, scheduled for next year. What’s undoubted is that more than almost anything else in the country, perhaps save crime and national security, the economy, its outlook and management, will be a major topic of debate.

Comments

"A tale of two TTs"