[UPDATED] Imbert gives 3-month tax amnesty

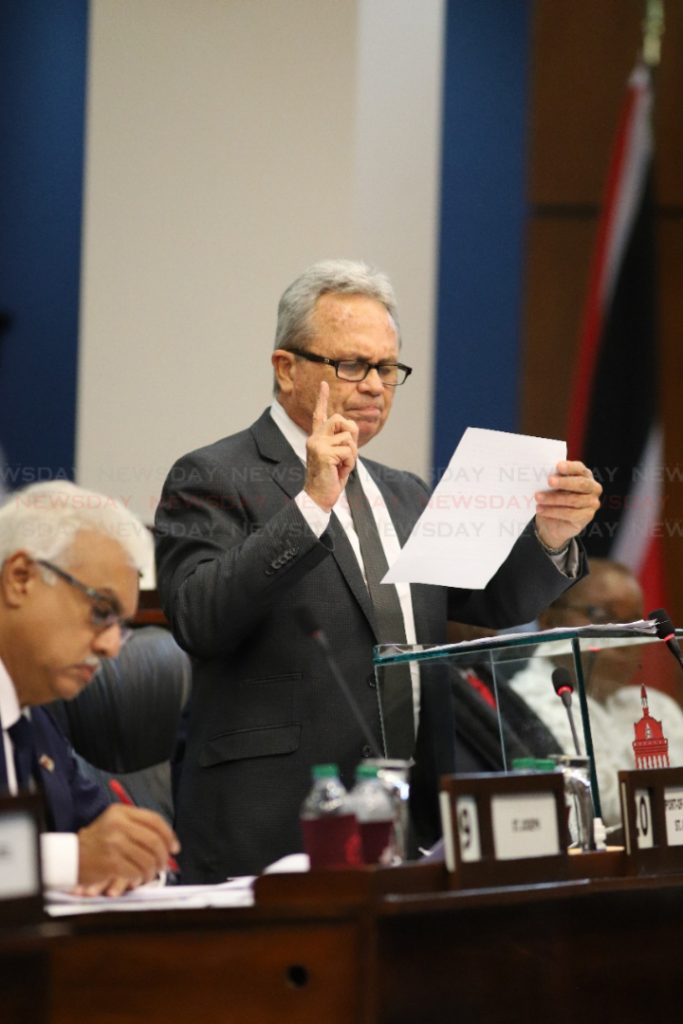

CITIZENS have three months, starting from mid-June, to file outstanding tax returns and pay back-taxes because once the TT Revenue Authority if off and running, future amnesties will be unlikely, Finance Minister Colm Imbert announced yesterday.

Delivering his mid-year budget review in Parliament, Imbert said at this time, Government has “no need whatsoever” to impose any additional burdens on citizens. The TTRA as a new entity will need to start with a clean slate, he said.

The authority will extend to all forms of taxation and the Government will introduce appropriate legislation to give it effect in the next few weeks. “Taxpayers are urged to take advantage of this amnesty,” he said.

The last time there was a tax amnesty was in 2016, and before that, in 2011. Opposition Leader Kamla Persad-Bissessar, in her presentation, directly after Imbert, questioned the definition of a “tax amnesty,” prompting Imbert to respond via Twitter.

“It is incredible the Opposition is pretending not to know what a tax amnesty is. There have been many tax amnesties under different Governments over the years. A tax amnesty allows taxpayers to file returns and pay outstanding taxes from previous years WITHOUT PENALTY,” he tweeted.

EXPANSIONARY INITIATIVES

Imbert, unsurprisingly, spent a significant portion of his approximately 45-minute presentation to highlight the Government’s achievements. “The reality is Madam Speaker that we have established a foundation on which we can now adopt expansionary initiatives, and this success has not occurred by chance,” he said.

The country had faced the brunt of the collapse of oil prices in 2014, causing a nearly 40 per cent reduction in revenue. but, he said, his government’s policies “managed to stabilise the economy, keep people in jobs, keep the country running and return the country to growth.” Not missing the chance to hit back at his critics, he added, “The pessimists and opposition voices inside and outside of the Parliament would have us believe that it is not so, but the facts and figures don’t lie.” He maintained his rhetoric of “turnaround” noting that, as the International Monetary Fund noted in a statement last Thursday, the pace of negative growth slowed in 2017, and moved into positive momentum in 2018.

For the first half of 2019 (October to March) revenue was $706 million more than estimated, while expenditure was $2.55 billion below, and the deficit only $1.85 billion. Recurrent expenditure for the first 6 months was lower than anticipated, at $23.63 billion, with reductions in expenditure on goods and services and interest payments amounting to $1.47 billion. Tax revenues were also higher than anticipated.

He was, however, forced to make some adjustments to initial projections in his October budget, including lowering the pegged oil price from US$65 per barrel to US$60 per barrel, but he also adjusted the natural gas price from US$2.75/mmbtu to US$3/mmbtu based on international commodity price projections.

SILENCE ON DRAGON

The Finance Minister’s delivery was already on a high from his spirited delivery in Parliament last Friday when he defended the government’s performance from the UNC’s motion of no-confidence in the economy.

What he didn’t dwell on, was the collapse of two of his six pillars as announced last October – Sandals and Dragon. He did, however, say he would approve a proposal that would allow the Tobago House of Assembly to raise $300 million in loan financing on the local market for development projects including health and sporting facilities, housing, roads and bridges, and coastal protection.

With regards to natural gas, he was adamant that natural gas production will continue to average 3.8 billion cubic feet per day in 2019, and hit 4 bcf in February, the first time since 2015. Oil production is expected to increase from 60,000 barrels per day in 2019 to 80,000 barrels by 2023. He also dismissed “alarmist reports” from newspapers regarding BPTT’s dry wells and the future of Atlantic Train One. Imbert also requested $1.8 billion in supplemental appropriations to various ministries and state agencies.

This story was originally published with the title "Imbert announces 3 month tax amnesty" and has been adjusted to include additional details. See original post below.

FINANCE Minister Colm Imbert has announced a three-month tax amnesty starting from June, as the government prepares for the introduction of the TT Revenue Authority. He made this declaration, capping off an estimated 45-minute presentation in the Parliament today.

Imbert hit back at critics, including the media, for alarmist and pessimistic reporting that caused unnecessary drama and unwarranted negativity, as he cited statistics to back up his claims that the economy had turned around.

For the first half of the year, Imbert said, revenue was $706 million more than anticipated and expenses $2.55 billion less, leading to a deficit of $1.85 billion.

He also gave updates on the government’s plans for infrastructural development over the next fiscal year, including major roadworks. Imbert had deferred making any comment on reports of BPTT’s dry wells when asked by the Opposition during the question and answer period, saying instead he would respond in his speech.

While he did not directly address the possibility that Atlantic Train One might be mothballed, he refuted reports that it was 4 wells that were dry, instead saying it was only two wells drilled, and one was dry, while the other will come on-stream soon, albeit at a lower than anticipated output.

This story will be updated.

Comments

"[UPDATED] Imbert gives 3-month tax amnesty"