Trotman: Nothing odd in timing of $78m loan to Monteil

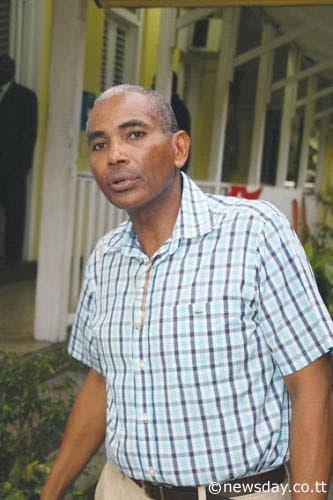

FORMER Clico Investment Bank (CIB) president Richard Trotman admitted on Thursday that the bank’s record keeping may have had its “issues,” but he saw nothing “odd” in the timing of the $78 million loan facility to its then chairman Andre Monteil.

Trotman was testifying at the trial of CIB’s million-dollar lawsuit against him, Monteil and two of Monteil’s companies – Stone Street Capital Ltd and First Capital Limited, St Kitts.

In his testimony, Trotman admitted to backdating documents relating to the loan when CL Financial boss, Lawrence Duprey, took over the facility from Monteil.

He said this was done to cover all the costs in the transaction so that Duprey could not say he was liable to pay because it was before he took over the loan.

The CIB – which is under the management of the Central Bank (CB) — sued Monteil alleging that a $78 million loan paid out in 2007 to facilitate Stone Street Capital’s acquisition of Clico’s 43.8 per cent interest in the Home Mortgage Bank (HMB), of which he was its former chairman until April 22, 2008, breached the bank’s internal controls and was an act of “self-dealing” given posts held by Monteil in the entities involved.

The CIB is seeking the return of some $110 million as a result of the loan transaction. The money being sought represent the outstanding $78 million loan balance, plus interest payments on the February 14, 2007 CIB borrowing issued to Stone Street.

It is being contended that the $78 million loan paid out to facilitate Stone Street Capital’s acquisition of Clico’s 43.8 per cent interest in HMB breached HMB’s internal control procedures and was nothing short of an act of “self-dealing” by Monteil, who was chairman of HMB and also group financial director of CL Financial.

The lawsuit accuses Monteil and Trotman of a series of wrongful actions and also takes the entire CIB board of directors to task for mishandling the situation and breach of fiduciary duties on several counts, among them the failure to ensure that the loan was fully secured. Monteil has testified that Stone Street Capital did not repay the $78 million but transferred it to Duprey, who wanted the 337,269 shares the former CIB chairman had in CLF. According to Monteil, the agreement was for Duprey to take over the loan debt and purchase the CLF shares which would have been transferred to First Capital Limited and later to Dalco – another company owned by Duprey.

He also said that the transfer of the $78 million to Stone Street Capital was done on the strength of an oral agreement and the CIB board accepted that the shares were being bought by the loan as security for the same loan.

Trotman yesterday denied the backdating of the loan agreement and other documents was to make it appear it was drafted on February 14, 2007.

He said it was done to get Duprey to fully guarantee the loan he had taken over from Monteil.

According to him, he found out that the CLF chairman had taken over the facility in September 2008.

“On its face, it appears to be offering a loan to Mr Duprey,” suggested CIB’s attorney Michael Green, QC.

“This is a regulated financial institution, yet here you are manufacturing a document,” he put to Trotman.

“We may have failed what we attempted to do… To get Mr Duprey to guarantee the loan,” Trotman said, accepting responsibility for it since according to him he signed the document.

He was also questioned about the initial granting of the $78 million loan to Monteil, days after he assumed the position of president of CIB and denied being prepared “to do anything to accommodate” him.

Both men previously worked together at CLF.

Asked if he trusted Monteil, he said he had a good working relationship with him.

Trotman also could not recall many of CIB’s credit policies although was the bank’s president.

“Why did it have to be paid on February 14? Was there a rush for the money to be paid? In 15 days of becoming president, the bank paid out $78 million,” Green asked of the $78 million credit facility to Monteil.

“I can’t recall why that date. I don’t know it was a rush,” he said, adding that Monteil wanted to close the transaction as soon as possible.

“It was a crazy situation isn’t it,” said Green to which Trotman said he did not think it was suspicious or that there was anything odd about it.

Trotman is representing himself at the trial which is being heard by Justice Avason Quinlan-Williams

Comments

"Trotman: Nothing odd in timing of $78m loan to Monteil"