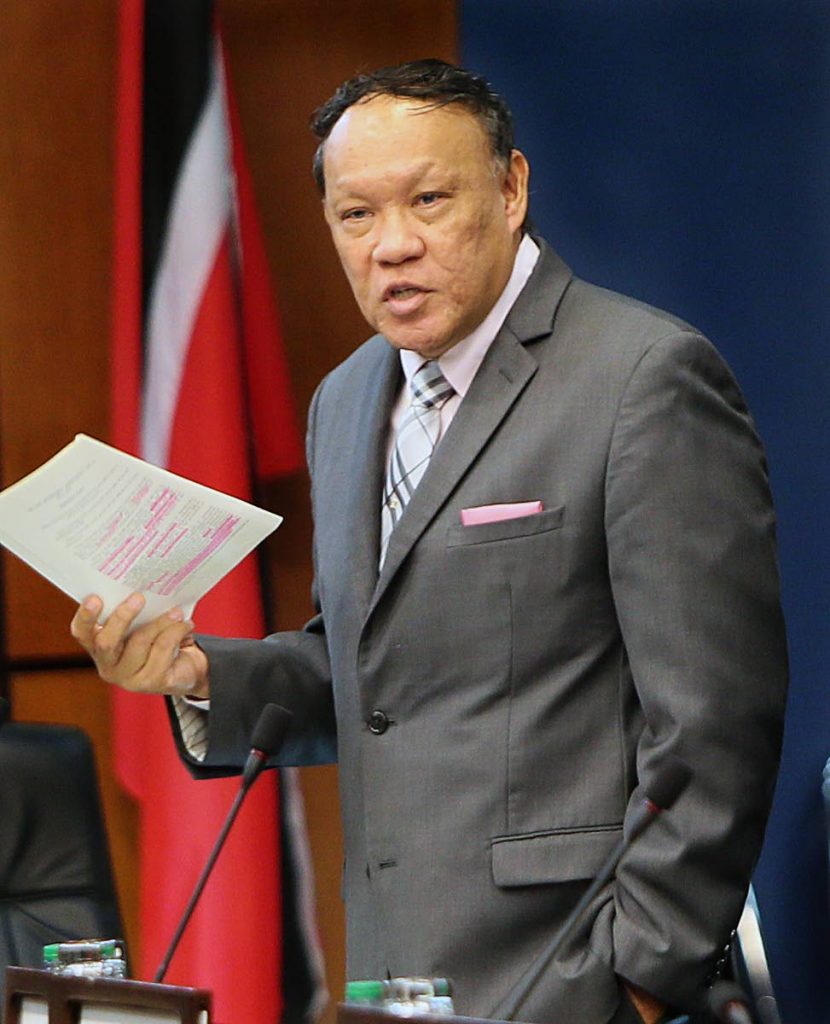

Lee: What turnaround? Economy in reverse

OPPOSITION whip David Lee said oil prices have plummeted since the budget was passed based on US$65 per barrel, and asked what the Government will do about a likely shortfall in its projected revenues. The West Texas Intermediary (WTI) oil price yesterday was US$46, compared to US$70 when the budget was read.

“In the last three months there has been a drastic decline. It’s very volatile. “Mr Imbert is way off his revenue figures,” Lee said, saying he was waiting to hear if the Finance Minister will adjust his budget.

“There’s a lot of volatility and even the output from the United States is increasing daily. They can be an exporter of oil, and are self sufficient.

“One has to ask the minister if the oil price continues to be depressed, in the first quarter of 2019 will he be coming back to Parliament to re-adjust his budgeted figure of his predicted revenues, which affect the deficit he has predicted.

“Is he going to borrowing more, to cover his debt-load which is already very high?”

He said the mid-year review is normally in April, although saying Imbert has been stretching it to May.

Newsday asked if the Government is likely to try to out-wait the low prices in hopes of a rebound by pushing back the mid-year review date.

Lee replied that any such delay would force the Government to borrow heavily in the meanwhile, perhaps early in 2019.

“In mid May, Mr Imbert spoke about a turnaround in the economy, but by now we must ask have we turned the corner or have we reversed? The Minister of Finance is very silent.”

Asked if the minister was playing a waiting-game and hoping for an oil-price rebound, Lee said, “While he is playing a waiting game, he has to pay bills. Are we to see ‘NIF #2’ soon,” he asked, referring to the National Investment Fund.

Lee speculated that plans to see off more state assets to private shareholders could be the reason the Government’s recent legislation in Parliament to allow insurance companies to invest a higher proportion of their asset base in bonds, from a previous figure of 25 per cent up to a new amount of 50 per cent.

“So the question is, was he laying the groundwork for more borrowing regarding the shortfall, if the oil dollar remains depressed. The last three months it averaged $50 to $53.”

Lee said the Petrotrin retrenchments have a knock on effect on the economy by reducing taxes paid under the PAYE and VAT taxes, all reducing confidence in the TT economy.

“It took $1 billion out of the economy regarding the Petrotrin payroll. That must have a domino effect.

“In the malls up to Christmas Day, people were shopping based on what they actually needed, not extravagance. There were no lines in stores. Traffic to get in the mall was easy.”

Comments

"Lee: What turnaround? Economy in reverse"