Price of recovery

The waters have now subsided in most areas after last weekend’s devastating floods, and people have slowly begun piecing their lives back together.

Insurance claims will be a big part of that recovery process.

“The objective behind insurance is indemnification — putting (the insured) back in a similar place they were before,” Musa Ibrahim, managing director of one of TT’s major insurers, Tatil, told Business Day.

There are at least three types or components of insurance available to property owners – the first is insurance that protects the building itself from fire, destruction, acts of God (natural disasters), for example. The second protects the contents of the building, like clothes, appliances, other personal items from theft or damage. The third covers personal liability arising out of someone hurting themselves on one’s property.

Unfortunately, as Business Day learnt during its coverage of the national disaster, many people, particularly those who may have personally funded their home construction, still do not have property insurance. Mortgages, however, usually require some type of coverage.

“From the banks’ perspective, we require the first type of insurance – the one that protects the building itself from damage. This is usually required because it reduces the burden on the homeowner in the event of damage to the physical property since the insurance will cover such damage and facilitate a speedier return of the homeowner to his or her pre-damage state,” president of the Bankers’ Association and managing director of Republic Bank, Nigel Baptiste told Business Day via email.

The bank is usually the beneficiary of the policy, he added. If a claim is made, what generally happens is the original mortgage loan will be repaid, either in full or in part, by the settlement and the homeowner will be able to re-mortgage the property to complete repairs.

Tatil’s Ibrahim noted, though, that this type of insurance tends to cover fixed property — so settlements would consider flooring or fixed carpeting and not, say, a throw rug.

Contents insurance is “paramount” if the building structure itself hasn’t been damaged, Baptiste said. “Hopefully, though it is not common and it is not a requirement for most mortgages, homeowners have insurance over the contents of their building. Where the homeowner does have this type of coverage, or is planning to secure it in the future, they will have to ensure that flood damage is not excluded from coverage,” he added.

Settlements for this type of insurance claim are paid directly to the homeowner to begin the replacement process.

For those who rent rather than own, Ibrahim recommends taking out contents insurance. “We (Tatil) have been encouraging people on the importance of contents cover,” he said.

Also important are motor vehicle claims. Vehicle insurance is mandatory under the Motor Vehicle and Road Transportation Act (MVRTA), but the type varies and not all cover flood damage. “Any comprehensive motor policy that covers ‘special perils’ should respond to the effects of flooding. Again, it’s not an automatic inclusion and not mandated by the MVRTA. So, depending on the nature of the insurer and the insured themselves, they may elect to add this type of coverage,” he said. Either, he advised the claimant to always enquire directly about the type of coverage and lodge a claim. The contract will govern the settlement.

But more than just buying insurance, Ibrahim advises that people ensure they have the right type of insurance and the correct value for the property and contents being insured. When they don’t, in the event of a total loss, their settlement may be less than the damage is worth because the policy may be subject to the “condition of averages.”

Depending on the type of policy, then, if the policy is under-insured, that is the value of the loss or damage exceeds the value that is insured, the insurer is only required to make a payment proportionate to the value that is insured. The claimant will therefore have to bear the burden of the difference.

Ibrahim recommended that people talk to their agent to ensure that the policies reflect the true value of the property and the adjustment can take place any time, regardless of the life of the policy.

It’s natural to see an uptick in inquiries or applications for insurance after a disaster, Ibrahim said. For example, after the Diego Martin floods in 2012, he noted an influx in people inquiring about special peril insurance for their cars after realising all their claims may not have been covered.

Ibrahim reassured that insurance companies would insure a property regardless of excessive risk, for example, in a flood zone. “Anything can be insured at the right price,” he said, although he did note that rates may be higher in these areas. What companies do, he said, was manage their risk of exposure so they don’t over-insure properties in a particular area.

Banks also won’t likely refuse mortgages because someone lives in a flood-prone location. Each bank will have its own approach to concentration limits, taking into account different variables including the risks associated with the particular area with respect to flooding, for example, Baptiste said. While concentration risk is a consideration, “our primary consideration is always the relationship with our clients,” he said.

Inside Greenvale Park

One of the hardest hit areas over the weekend was Greenvale Park in La Horquetta, a housing development managed by the Housing Development Corporation. Floodwaters were reported reaching over five feet high.

In an email to Business Day, an HDC spokesman confirmed that once properties were mortgaged, they would have automatically been insured. For rental units, the HDC will oversee repairs for structural damage, including plumbing and electrical. The agency will also offer assistance to homeowners in development. Greenvale has 550 units–435 single family units and duplex single family units, 64 townhouses and 51 apartments.

Since the floods struck, the HDC has been on site working with other agencies like CEPEP, the Defence Force, Fire Services and regional corporations to assist residents with cleaning up. The agency's social and community services department has also been on site interviewing affected residents. Information is submitted to the Ministry of Social Development and Family Services to process for relief grants.

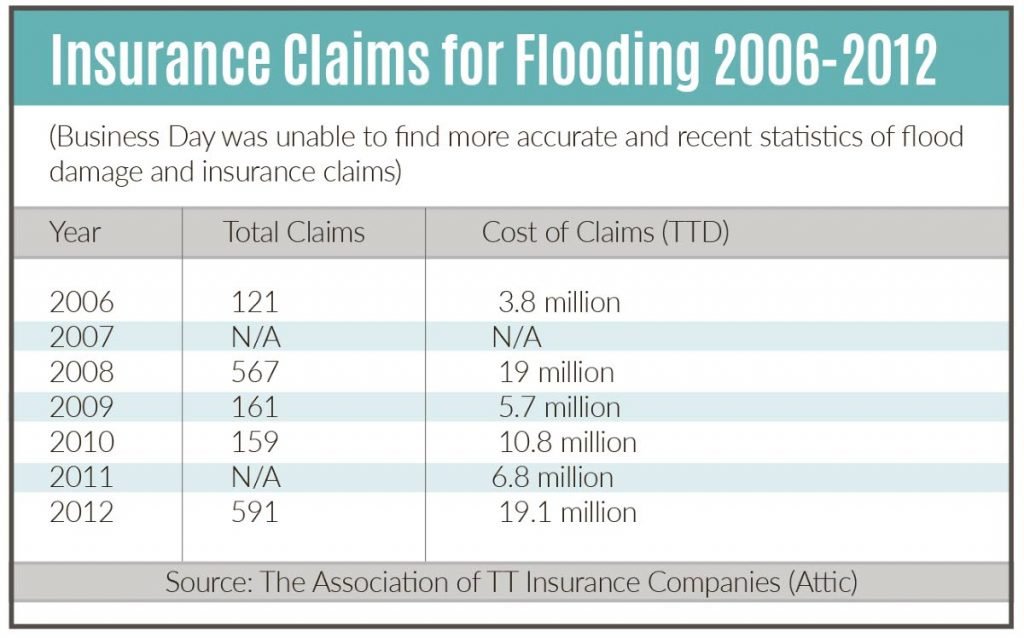

There has yet been no official assessment of the damage and economic impact of last weekend's floods.

Comments

"Price of recovery"