Get cash with no card

You are more likely to forget your wallet or debit card at home than your phone, which poses a conundrum if you need money but have no cash on you.

This is exactly the kind of problem you no longer have to worry about while in TT, thanks to Republic Bank Ltd's (RBL) new Cardless Cash service.

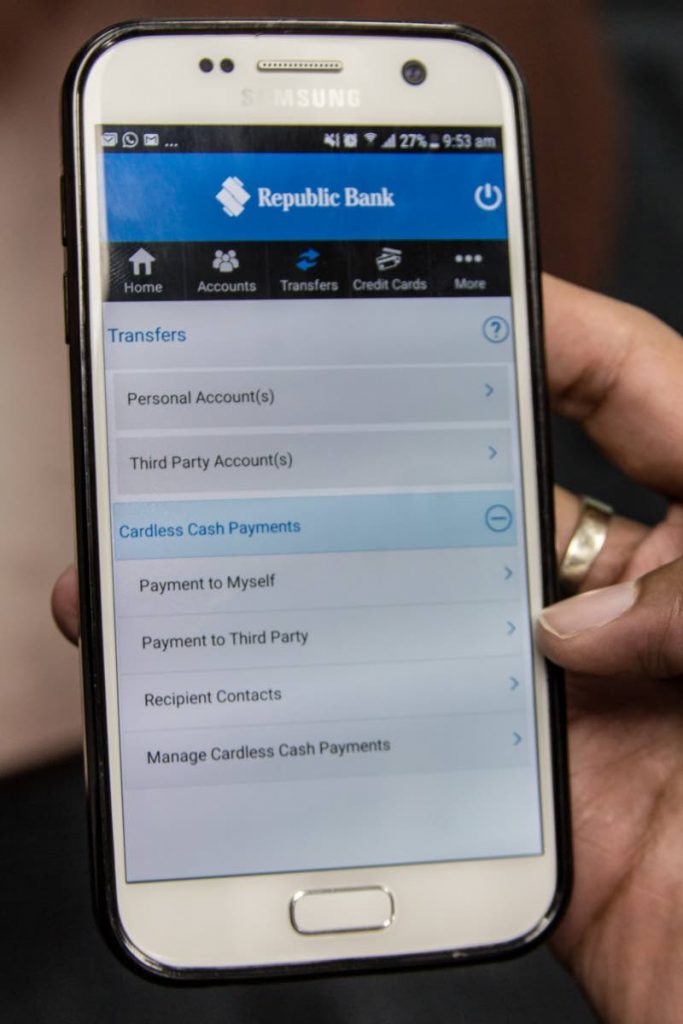

Launched yesterday at the bank's Electronic Channels and Payment Division, Ellerslie Plaza, Maraval, Cardless Cash is a feature of the RepublicMobile App and RepublicOnline.

It allows users to access up to $500 a day from any Blue Machine – RBL's automated banking machines (ABMs) – which they can then send to themselves or anyone else who has a mobile phone.

Existing customers registered for these services can simply log on to use this feature. New customers can sign up for RepublicOnline and download the RepublicMobile app to their phone or tablet.

"We've been looking at options to make access to electronic funds or even cash more convenient to our customers and this was one of the mechanisms we thought would be really helpful," Denyse Ramnarine, general manager of the division, told Business Day ahead of yesterday's launch. "(While) it isn't available via the LINX network of ABMs, Republic does have the biggest ABM network in TT – more than 120 – so it's totally up to the person receiving the cash to choose the ABM most convenient to them.

“We saw a similar product in Europe and at the Bank of Hawaii but as far as we know, we are the first bank to provide a product like this in the Caribbean."

There is a $4 fee – the same amount you pay to use LINX at the ABM – but customers will not have to pay for the service until June 30.

"While the charge will still appear on the confirmation screen," RBL said, "it will not be debited from your account" during the fee-waiver period. From July 1 however, $4 will be debited from the sender's account, per transaction, once the cash has been withdrawn.

PAYMENT TO MYSELF

To use the service, log in to either the RepublicMobile app or the RepublicOnline (personal) service and select Payment to Myself via the Transactions tab in the main menu of RepublicOnline or the Transfer Funds tab on RepublicMobile App.

The cash code and transaction ID can be sent via SMS (text message) and/or email to your registered mobile number or email address.

Next, enter the amount of money you want to send to yourself – this must be divisible by 20, as the bank's ABMs only dispense $20 and $100 bills.

You must withdraw the cash within 48 hours because the transaction ID and cash code both expire 48 hours from the time the transaction was initiated.

PAYMENT TO THIRD PARTY

In the age of smartphones, you don't need to own one to receive money from an RBL customer via Cardless Cash. As Ramnarine pointed out, "you can access Cardless Cash from a 'me too' phone. All the sender needs is your mobile number."

There are two options when sending the requisite information to a third party. You can either send both the transaction ID and cash code via a text message or have the cash code sent to your registered mobile number, again via text message, while the transaction ID is sent to the recipient’s mobile number.

You will then have to give the transaction ID to the recipient so they can withdraw the money from an RBL ABM.

The RepublicMobile app is only available to registered RepublicOnline users, so recipients must first be added to your contacts list, via RepublicOnline, before they will be available on the app.

Once you've done that, log in to the RBL mobile app or online banking platform but in this case, select Payment to a Third Party. Enter the transaction amount, followed by the recipient’s name and mobile number.

Like payments to yourself, the transaction ID and cash code "must be used within 48 hours from the time that the transaction was initiated," RBL said.

Once the third party has withdrawn the money, you will be notified of this via email and text message.

Ramnarine pointed out that if you change your mind on sending money to a third party, you can cancel the transaction within 48 hours, once the recipient has not withdrawn the money.

She also told Business Day the option to send only one of the two required pieces of information provides you with an added sense of security.

"You can make the choice, as the person sending the money, to send both codes or just the cash code and have the receiver contact you to get the other one. Some people prefer to have the person call them so they can confirm the number they sent the cash code to was correct."

If you are abroad and need to send money to someone here in TT, you can do so once you have access to either RepublicOnline or the RepublicMobile app. The same procedure applies as when you are in-country.

Ramnarine also said if the chosen RBL ABM happens to be out of cash at that time, you can use the same transaction ID and cash code at another Blue Machine.

Comments

"Get cash with no card"