Permell and Elias concerned about NCB’s take-over bid for GHL

Peter Permell, a minority shareholder in Guardian Holdings Limited (GHL), says the offer price of US$2.35 a share by NCB Financial Group (NCBFG) should be higher to reflect the current valuation of shares.

“The offer was for US$2.35 per share, which works out to almost TT$15.60 because you have to use the US dollar buying price from the bank because a lot of shareholders will not have US dollar accounts. The offer document (had) no reference to a TT dollar price. More than that, the valuation presented in the Directors’ Circular (dated December 29) spoke to a price range between $16.99 and $19.50, which is significantly higher than the offer price.”

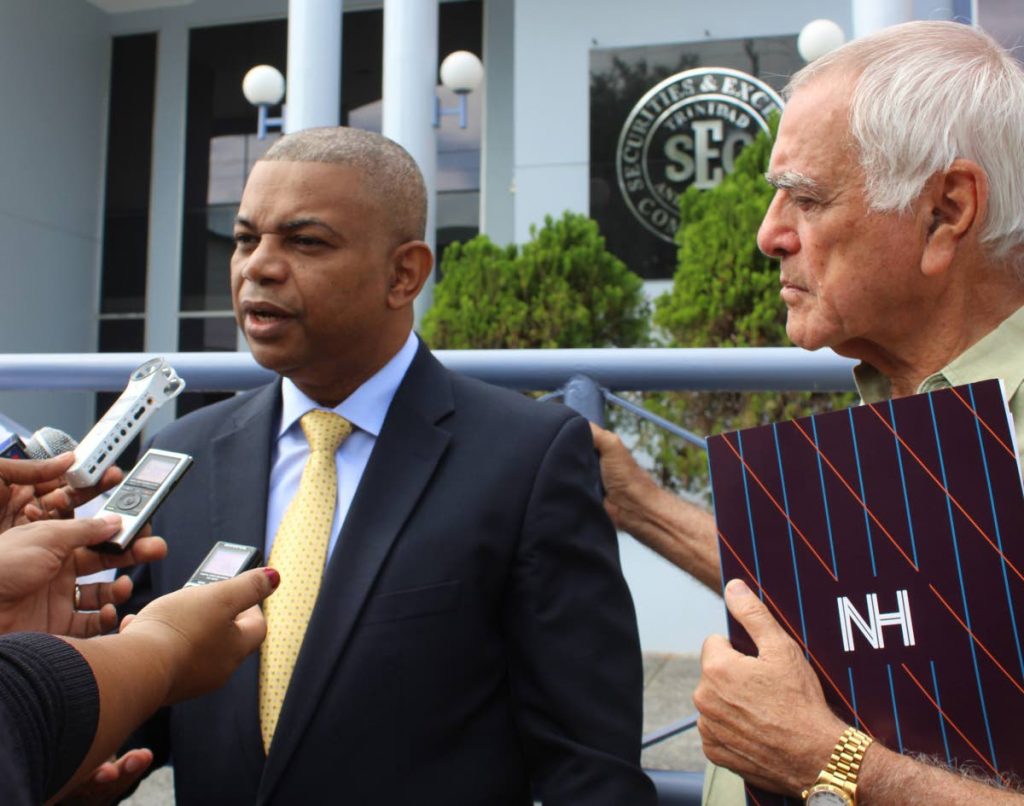

Permell was speaking to the media yesterday following a meeting he and fellow shareholders, Emile Elias and Gordon Laughlin, as well as former stockbroker Winston Padmore, had with the TT Securities and Exchange Commission (TTSEC) about the take-over offer.

“The TTSEC has given us an undertaking that they are going to look into it and get back to us.”

On December 8, 2017 the Jamaica-based NCB Financial Group (NCBFG) announced its intention to acquire up to a majority stake – up to 62 per cent – in GHL.

NCBFG already owns 29.9 percent of GHL - those shares were acquired in May 2016, following an agreement signed on November 30, 2015 to buy said shares from the Lok Jack and Ahamad families as well as from the International Finance Corporation – the World Bank’s private sector arm.

NCBFG said last month that “further acquisition of shares in GHL is aligned with the NCB Group’s vision and will create a truly pan-Caribbean diversified financial services conglomerate.”

The takeover bid is being made through NCBFG’s wholly-owned subsidiary, NCB Global Holdings (NCB Global Holdings, to acquire up to 74,230,750 ordinary shares in GHL for US$2.35 per GHL Share – GHL is a publicly-traded company incorporated here in TT. If successful, the Offer would result in NCBFG acquiring a controlling interest in GHL.

Unless extended, the Offer period will close next Friday, January 12. Full acceptance of the Offer would result in a cash payment by NCBFG of the sum of up to approximately US$174,442,262.00 to the shareholders of GHL who accept the Offer.

The Offer is conditional upon NCBFG acquiring control of GHL and obtaining regulatory and other approvals required to acquire the GHL Shares in TT, Jamaica as well as all other jurisdictions in which GHL and its subsidiaries are regulated.

Standing on the sidewalk in front of the TTSEC’s Dundonald Street, Port of Spain offices, Permell called for public disclosure of the 2015 agreement between NCBFG and the Lok Jack and Ahamad families, saying how much they were paid and what they agreed to, are of interest to shareholders and GHL policyholders.

He said based on information in the public domain, they had deduced that the Lok Jack and Ahamad families were paid TT$21.00 for their shares.

“That hasn’t been disclosed in either the offer document or the directors’ circular. It was a private (sale) but up until now because once an offer is made to acquire the shares of the other shareholders, then that is material information that should be disclosed.”

“This is not an issue not only for the shareholders of GHL,” Permell argued. “You’re talking about tens of thousands of policyholders who are going to be impacted one way or the other because what we don’t know the future projections, the plans, for GHL. Although they said they’re not going to have any change in the dividend policy, that they’re not going to amalgamate the company, that doesn’t mean anything. Some statement needs to be made to indicate what are their plans for GHL going forward.”

Adding to what Permell said, Elias told reporters “there are a number of disclosure issues missing from the offer document, which the SEC code requires...I’d like to see some more material financial disclosures as well as the other things that Peter Permell has spoken about.”

Elias also called for a TT dollar offer in addition to the US$2.35. He argued that with the local foreign exchange shortage and the estimated conversion at TT$15.60, “in order to get the proper value” shareholders would have to sell their US dollars on the black market.

Comments

"Permell and Elias concerned about NCB’s take-over bid for GHL"