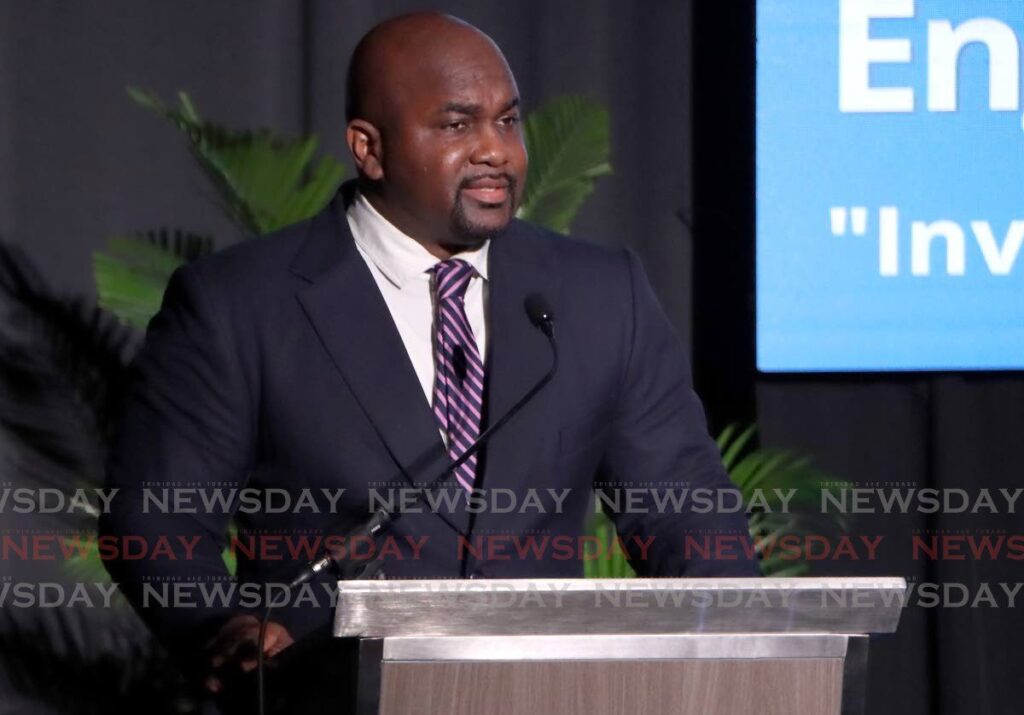

Manning: Securities industry vital for economic development

MINISTER in the Ministry of Finance Brian Manning has said it was crucial for Trinidad and Tobago to recognise the significance of the securities industry in its role of bolstering the country’s economic well-being.

He made the statement in his keynote address at the TT Securities Exchange Commission (TTSEC)’s strategic stakeholder engagement forum at the Hyatt Regency in Port of Spain on June 14.

“The securities market offers both individuals and institutional investors a wide range of investment opportunities beyond traditional asset classes like savings accounts and real estate,” he said.

“Our citizens have the opportunity to invest in stocks, bonds, mutual funds, and other financial instruments to build their wealth over time, support entrepreneurial endeavours, and actively contribute to the country’s economic advancement.”

He added that the industry also facilitates capital through connecting investors with business and government entities that need funding. It also promotes liquidity and risk sharing.

“By participating in the securities market, individuals are allowed to accumulate wealth over time.”

He said market capitalisation (the total dollar value) of the TT equity and mutual funds in the market amounted to $122.53 billion. He said that is a sign that the market continues to exhibit signs of growth, with the volume of trades in the secondary market (where investors buy securities from other investors) increasing by 81.65 per cent and the traded volume increasing by 47.11 per cent.

Manning said the Government is committed to supporting access to capital through mechanisms such as initial public offerings, secondary markets, private placements and venture capital options.

“We recognise that access to capital is the lifeblood of economic development, particularly for small and medium enterprises (SMEs).”

He pointed out the National Investment Fund Holding Ltd as one of the Government’s mechanisms to foster local capital markets. He said the Government empowers SMEs to thrive by nurturing an environment that encourages capital formation and innovation.

“At present the total value of bond issuances listed with the Stock Exchange stands at $19 billion.”

Comments

"Manning: Securities industry vital for economic development"